In 2017, the west region of the province, particularly the south-west region, experienced severe dry conditions that affected crop yields, water quality, feed supplies and contributed to the worst wildfires we have seen in years.

The producers and ranchers are getting ready for another season this year. Have those challenges of 2017 affected solvency, liquidity and cash flow on farms in the west region? Will that affect farming practices and crop production in 2018?

For last 10 years or so, the west region and, in fact, the whole province has enjoyed strong commodity prices, adopted new technologies, took advantage of low interest rates, and gained significant asset growth. Could good production in the years prior to 2017 compensate for the last year’s issues and challenges?

In light of these outcomes and questions, I did some research on numbers and statistical trends on balance sheets of Saskatchewan farms for last 20 years (Statistics Canada, 2016). In this article I will provide some comments on provincial farm debt to asset ratio, working capital (WC), WC to annual operational expense ratio (WC/AE), and how these measures might help assess this year’s cropping plans and crop budgeting for the west region farms.

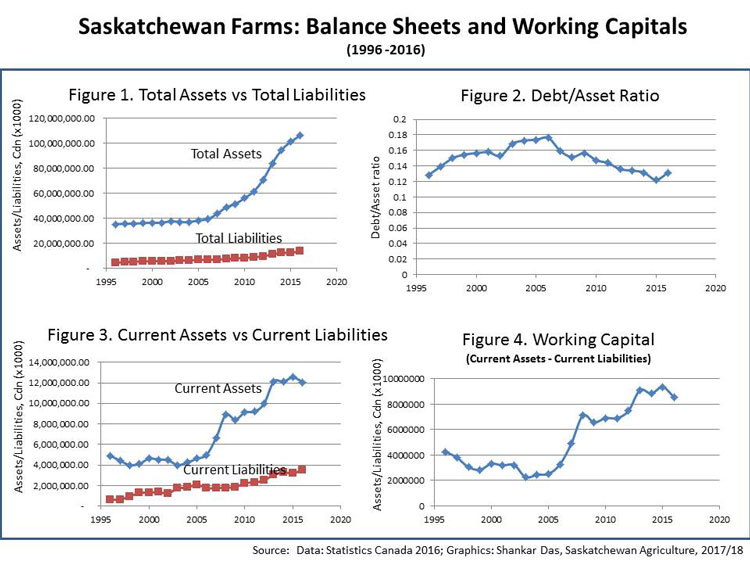

As you can see in Figure 1, farm asset values in Saskatchewan have almost tripled compared to total liabilities in the last 10-12 years. According to experts, the unusual rise in asset values for the last 10-12 years has mainly been through land value appreciation in the province.

This trend has apparently affected the debt to asset ratio to one of the lowest levels since 2005 (Fig. 2).

Similarly, the value of current assets have also increased significantly compared to current liabilities over the same period (Fig. 3) which is reflected in increased levels of working capital

(current assets minus current liabilities) (Fig. 4). It means producers, on average, seem to have been experiencing higher solvency for some time indicating less risk to farm’s financial wellbeing. [In farms, current assets are cash, inventory, prepaid expenses and accounts receivables, compared to current liabilities which include operating and supplier credit balances, accounts payable, interest and lease payables etc.].

According to Kim Gerencser of K.Ag Growing Farm Profits Inc., a lack of adequate working capital presents the greatest single risk to the future of any farm business. Fortunately this is not the general trend as indicated in Fig.4.

Ron Monette, a provincial financial management specialist with the Ministry of Agriculture, says working capital is a complementary measurement to the current ratio (current assets divided by current liabilities) that measures current financial health of a farm. According to industry standards, a current ratio between 1.5 – 3 is a healthy range. In 2016, the ratio was more than 3 which means, on an average, a farm has 3 times more current assets than it has its current debts. However, although a positive value is desirable, a too large a value may indicate too many low return assets are being held.

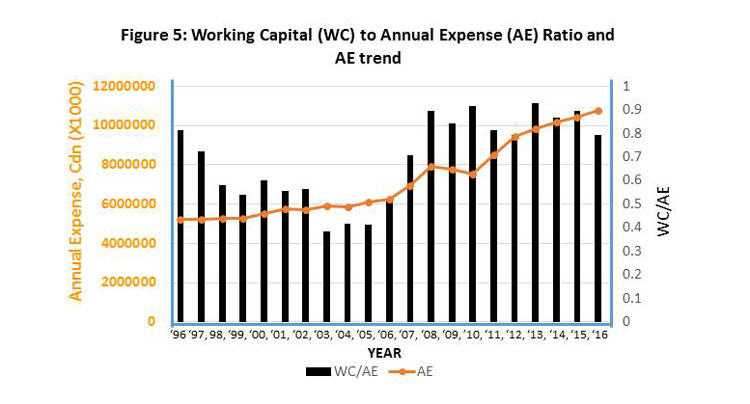

Since a current ratio does not indicate how well a farm would be able to meet its annual operating expenses, industry experts put emphasis on another measure, working capital to gross or annual expense ratio (WC/AE ratio) on yearly basis. Figure 5 shows that Saskatchewan farms have met close to 80% of their annual operating expense with their working capital in 2016. According to Ken Evans of Ministry of Agriculture and Paul Kuntz of Wheatland Financial, the WC/AE ratio trend for last 10 years is a healthy one (Fig.5).

However, the farmers of the west region may have to consider two other factors in their 2018 crop budgeting: their 2017 losses due to the challenges mentioned above and the annual increase in operating expense. Figure 5 shows a 20 year annual expense (AE) trend indicating that farm’s annual operating expense has been increasing at more than 2.5%.

The data and the analyses shown above are based on farm’s overall performance and do not show the contribution of each of the enterprise such as crops and livestock separately within a farm. Furthermore, region-specific data are also not available to analyze and assess the financial picture of the west region which faced multiple challenges in 2017 to show how those challenges might affect their working capital and their 2018 crop season.

Having said, a healthy working capital is critical to every farm prior to each crop season and for crop budgeting. High liquidity and solvency will provide better flexibility and will likely dictate what crops to grow next year for higher profits. The Ministry of Agriculture’s Crop Planning Guide 2018 is a popular guide which can help with crop production budgeting for 2018.

For more information, contact Shankar Das at 306-867- 5577 or the Agriculture Knowledge Centre of the Ministry of Agriculture at 1-866- 457-2377.

For more articles like this, ‘Like’ the Kindersley Social Facebook page below…